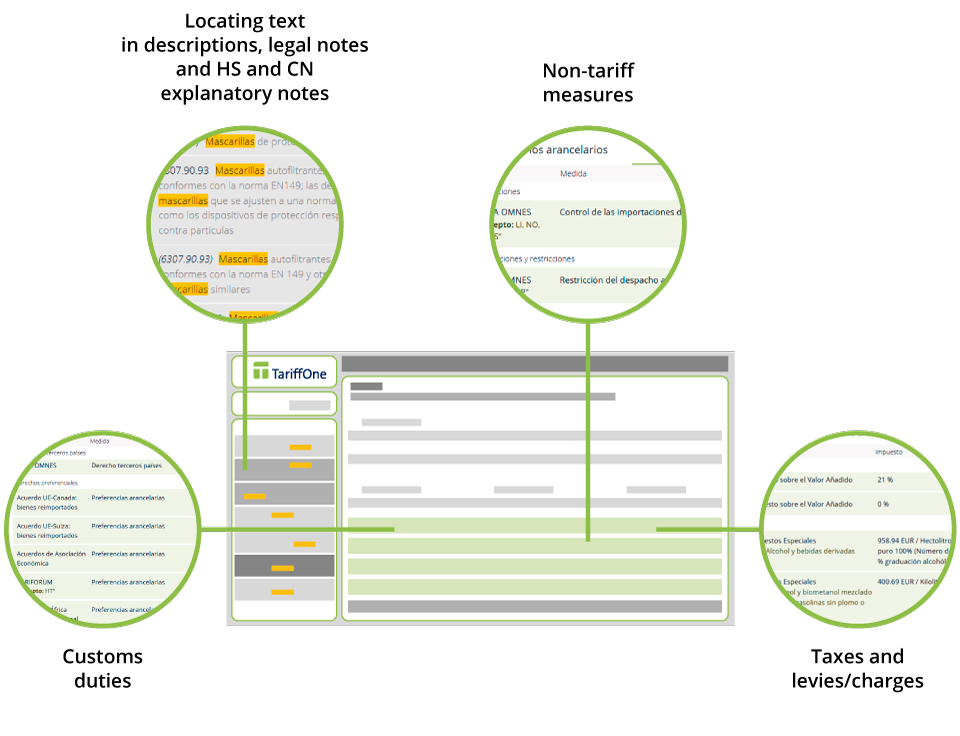

Discover the new online application that simplifies the analysis of information on duties to be paid and requirements to be met during import and export operations.

TariffOne seamlessly integrates a constantly updated tariff database with the customs clearance legislation and procedures of various countries.

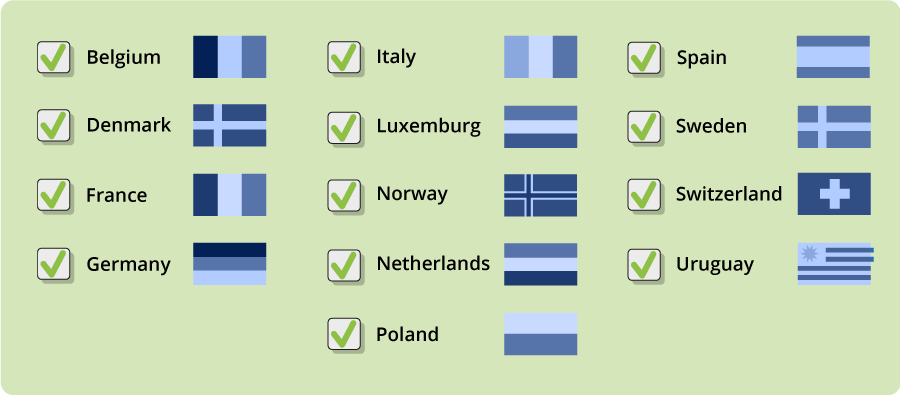

What sets TariffOne apart is its unique ability to integrate multiple countries and languages into a single platform.

Currently TariffOne covers nine EU countries along with Norway, Switzerland and Uruguay, with new countries being gradually added. Users can consult the customs tariffs and legislation for a wide range of countries, while considering specific tax features of certain territories, such as France’s overseas regions.

The application also provides access to descriptions of tariff headings and notes on EU measures, available in several languages.

TariffOne compiles information from various official sources. This data is continuously updated through a compilation and analysis system supervised by Taric WTG’s team of experts in customs regulations and international trade.

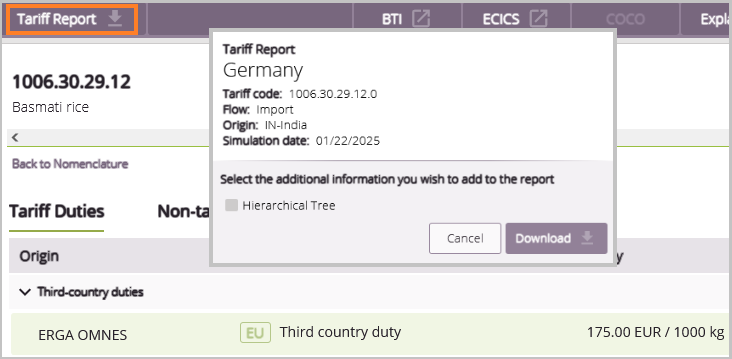

Download tariff reports in PDF format

After selecting the origin or destination, users can generate and download a report in PDF format based on the corresponding tariff code. This report includes customs duties, non-tariff measures, taxes and other charges.

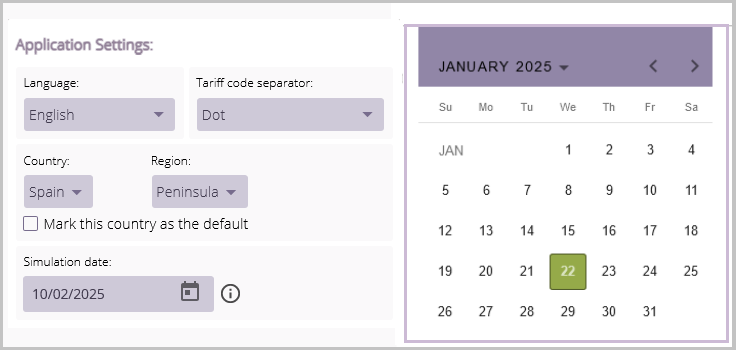

Consultation by date

TariffOne has introduced a function that enables users to view data for dates other than the current one either in the past (from 13-11-2022) or in the future (depending on information provided by the relevant authorities).

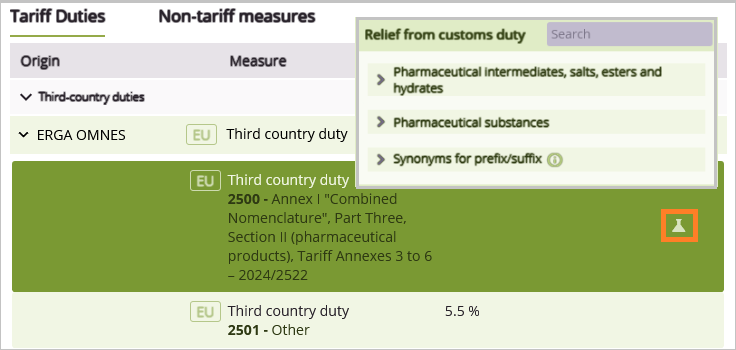

Tariff exemptions - pharmaceutical substances

This feature, unique on the market, provides information on pharmaceutical substances benefiting from a tariff exemption, referenced by their CAS (Chemical Abstracts Service) code. A search engine is available for locating these substances by their CAS code or name.

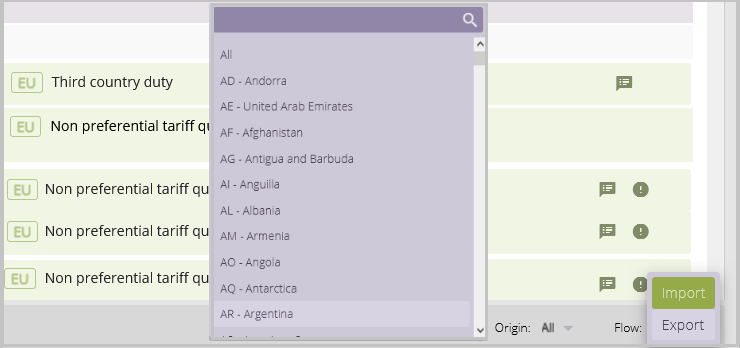

Filtering by country and/or flow

TariffOne offers intuitive access to relevant information for a selected country, filtered by import or export flow.

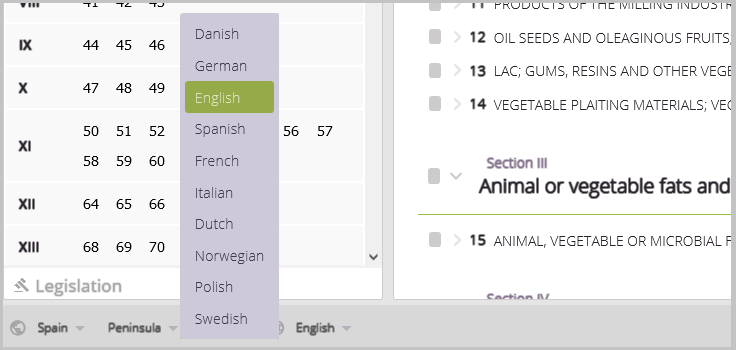

Multilingual content option

The application provides descriptions of tariff headings and notes on EU measures in multiple languages.

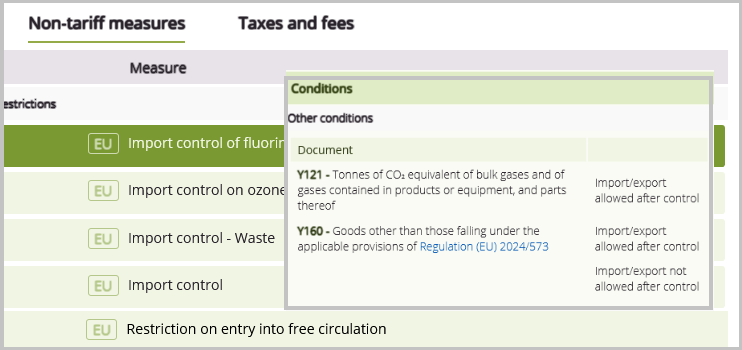

Codes for SAD boxes 36 and 44

The codes required for box 36 (preference) and those to be declared in box 44 (documents, special tariff provisions, certificates, proofs of origin) are adeclared with the tariff measures.

Want to try? Request temporary access at comercial@taric.es

TARIC S.A.U. utiliza cookies propias con la única finalidad de dar acceso a la navegación y a los servicios y productos solicitados y cookies de terceros que tratan sus datos de forma agregada y con finalidades exclusivamente estadísticas. Este sitio web no utiliza cookies de publicidad comportamental.